Unlocking Money’s Potential: Changing Your Mindset

Money is a necessary element in our lives, however, it can either be a source of freedom or a constant source of stress. The way you perceive, and approach money largely determines how your life will unfold. It is what drives the way you handle money, as well as how you save and spend. If you hold limiting beliefs or show overconfidence with money, you create barriers to your financial success.

Shattering Limiting Beliefs and Overconfidence

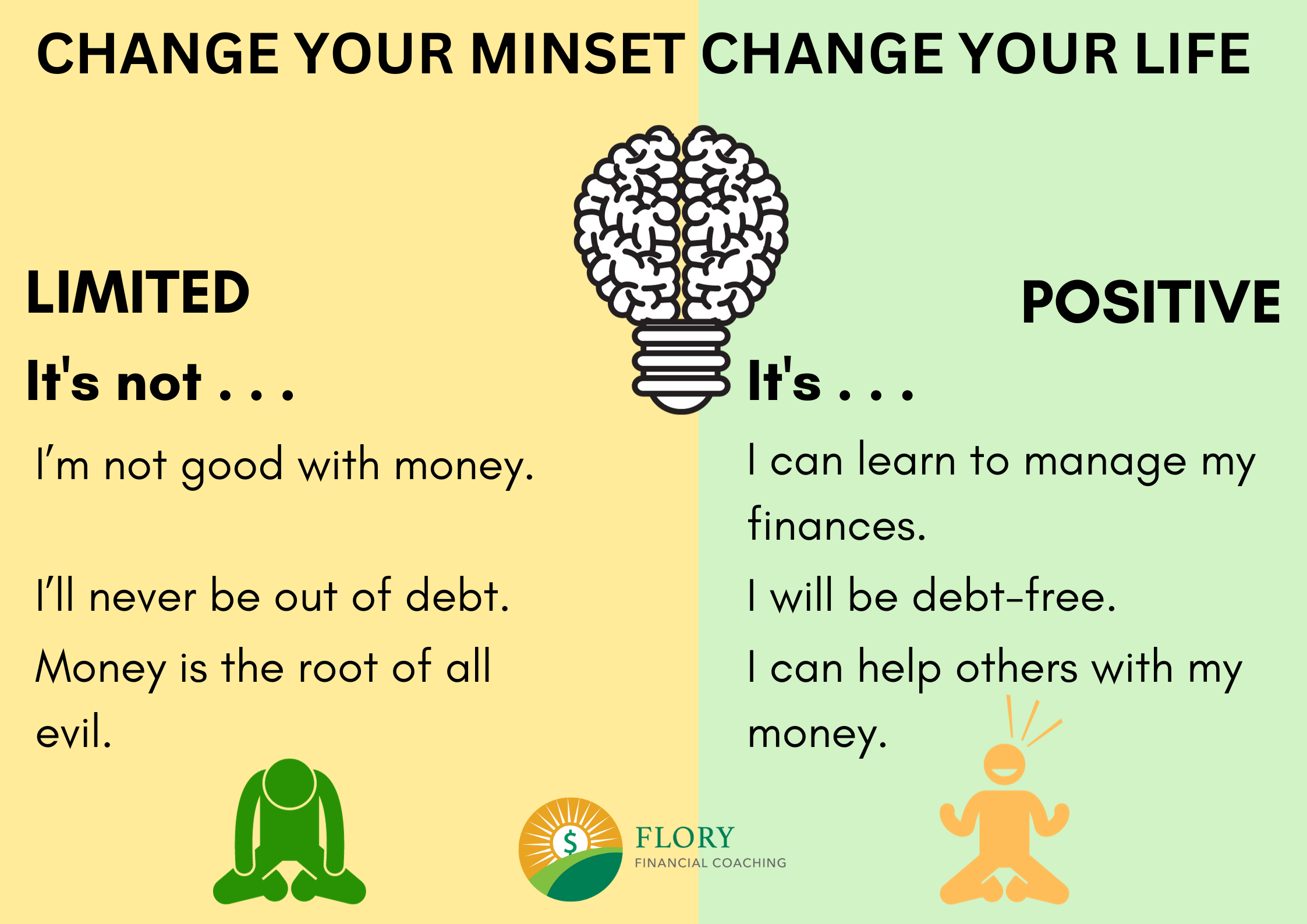

Limiting beliefs are deeply ingrained thoughts that hold you back from achieving your goals. These beliefs can be about your own capabilities, worth, or ability to manage money. They may come from how your parents talked (or not talked) about money. They may also come from your own experiences such as having a part-time job or side business while you were in school. These different experiences are the main cause of money fights in marriage. Some common limiting beliefs about money include:

- “I’m not good with money.”

- “I’ll never be out of debt.”

- “Money is the root of all evil.”

Overconfidence can lead you to overestimate what you actually can afford causing you to stay in debt. Some common thoughts that can lead to overconfidence include:

- “I can make the payments.”

- “I make a lot of money, so I don’t need a budget.”

- “I can time my investments in the market.”

These beliefs can be difficult to change, but it is possible to reframe your thinking and adopt a more positive money mindset.

Cultivating a Positive Money Mindset

A positive money mindset is characterized by a belief in your ability to achieve financial success. It involves recognizing your strengths, taking responsibility for your financial actions, setting realistic goals, and believing that you can reach them. Once I realized that I could have control over my saving and spending habits, this is when my mindset shifted. I no longer had to spend my bonus or pay raise at another one day sale or on another new “toy”. I could take time to think and intentionally tell my money where to go.

Here are some steps you can take to cultivate a positive money mindset:

-

Identify your limiting beliefs. Awareness is the first step to change. Write down any negative thoughts you have about money. Where did these beliefs come from? Many times, we develop our beliefs based on how our family or friends handled money.

-

Challenge your beliefs. Are these beliefs based on facts or on fear? Write them down. Look for evidence to support or refute these beliefs.

-

Replace negative thoughts with positive affirmations. Instead of saying “I am not good with money,” say “I can learn to manage my finances.” Once you shift your beliefs, your behavior will start to change as well.

-

Focus on gratitude, not a scarcity mindset. Instead of thinking about what you don’t have, which can lead to overspending, focus on what you do have. You can also give or donate to others which can help you become more selfless.

-

Set realistic financial goals. Having clear goals will give you direction and motivation. For example, if paying down debt is a goal, break it down into smaller more manageable goals. This will you to achieve those quick wins.

- Create a budget. This will help you track your income and expenses to see where your money is actually going. It will also give you the freedom to not feel guilty when you do spend.

-

Take action. Don’t just sit around and wait for things to happen. Take steps towards your goals, even if they are small steps.

-

Celebrate your successes. Take the time to appreciate your accomplishments, no matter how small they may seem.

Remember, changing your money mindset takes time and effort. But by adopting a more positive outlook, you can create a more fulfilling and prosperous financial life.

Additional Tips for Shifting Your Money Mindset

-

Read books and articles about financial success. This will help you learn about different strategies and mindsets that can lead to financial wealth.

-

Attend workshops or seminars on personal finance. This can provide you with practical advice and guidance from experts.

-

Find a financial mentor or coach. A mentor can provide you with personalized support and encouragement. They can also hold you accountable for your actions.

-

Surround yourself with positive people who share your financial goals. This will help you stay motivated and on track. Don’t keep up with the Joneses. Breaking free from the crowd will keep you on the path to success.

-

Don’t give up! Changing your money mindset and your financial behavior is a journey, not a destination. There will be ups and downs along the way, but don’t give up on yourself.

By taking these steps, you can start to think differently about money and create a more positive and prosperous financial future that will change your life!

To schedule your complimentary consultation, please click here: