According to the Federal Reserve Bank of New York, Americans’ total credit card balance is $925 billion (in the third quarter of 2022). Back in 1999 that total was $480 billion. It is getting easier to use a credit card more than ever. You don’t even need to physically have your card. You can now store it on your digital wallet and tap your phone at check-out and even store it on your fitness watch. If you search the internet for help, you may find there is conflicting information on whether you should or should not use credit cards. I am going to share some history and my own story that may help you stay out of credit card debt.

Putting purchases on credit is nothing new. Looking back through time, people often bartered or used credit for exchange of goods and services. If you have ever watched Little House on the Prairie, you may remember watching the pioneers putting items on credit at the Mercantile. In 1949 Frank McNamara and his business partner Ralph Schneider created “The Diners Club Card”. Frank got the idea from when he forgot his wallet and couldn’t pay for a business dinner. He proposed a card that could be used for dining at certain restaurants and then paid in full every month. Before long banks such as American Express, Chase, Capital One and Bank of America started issuing credit cards. These types of cards allowed users to carry their credit card balances from month to month.

So how did credit card debt get so out of control and why are so many people struggling, filing bankruptcy or even getting divorced? I think the need for instant gratification plays a very important role. Growing up in the 70s, I remember my parents taking my brother and myself shopping. My parents did not make a lot of money so they would put our school clothes or birthday presents on layaway. Layaway originated during the Great Depression and allowed a customer to put a deposit on an item (like furniture, televisions or clothes) but instead of taking it home, the seller would hold the item in the store. The customer would then make installment payments on it over time. Once the balance had been paid in full, the customer could pick up the item and take it home. We had to have patience waiting for the day we got our items unlike credit cards. With credit cards you can take the item home or order it online and pay for it later.

Sounds like a great idea but this leads to the problem. Most people will say that they will just pay the credit card off once they receive the bill. But according to the Federal Reserve, only 45% of Americans actually pay their card balance every month. This is what happened to me. I was swayed into getting a credit card when I was in college. It was around Christmas and they were giving away a cute little set of glasses with Christmas trees on them to everyone that opened a card. I know that might sound crazy but it was enough for me to open my first card. At the time I was only working on weekends so I didn’t use it all that much. But once I started working, I found myself charging things on it and just making the minimum payments. I charged furniture for my apartment, vacations and even day to day expenses when I did not have enough in my checking account. Before I knew it, I had racked up $10,000 in credit card debt. It was a real wakeup call when I read on my statement that it would take me 20 years to pay off my card if I only made the minimum payment. Even if I paid $300 a month it would still take me 3 years.

According to Bankrate the current credit card APR (annual percentage rate) is 19.93%. What that means is if your credit card balance is $10,000, you will pay 19.93% interest on that in one year. So, in this example the interest for the year would be $1,993 (10,000 times 0.1993). Each month the interest added to your balance would be $166 (1,993 divided by 12). As you can see only paying the minimum payment and having that interest tacked on every month will definitely keep you in debt.

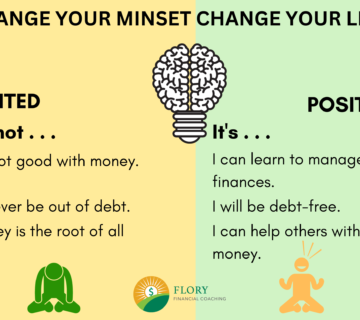

Another part of credit cards that can keep you trapped in debt and increase the risk of impulse buying is the bonus rewards. Whether you are promised points, cash back or miles, you will more than likely end up spending more than you had intended just to get that reward. The bad news is that nothing is really free and the credit card companies can change their terms at any time. The only ones that really make out with the bonus rewards are the credit card companies. They do this in the amount of fees they charge you when you cannot pay your bill in full at the end of the billing cycle. They also get you by causing you to pay more in increased prices on the goods and services you buy. You may have noticed having to pay a merchant fee when you use a credit card online or at some places of business. Don’t fall for these tricks. Instead work on changing your behavior and mindset about credit card debt.

When I realized I needed to change my behavior, that is when things started to change for me.

- I stopped using the credit cards.

- I got on a budget. That way I could see where my money was going.

- I started thinking more intentionally with my money and started to prioritize my expenses. I had to think if something was really a need or just a want. I couldn’t always go out to dinner or go on an expensive vacation. I really had to cut back on my spending.

- I started saving for an emergency fund. I started with $1,000 first. That way if something came up, I wouldn’t be tempted to put it back on a credit card. I had done that in the past. I would pay off a card, not have anything saved in an emergency fund and get into the same trap. I wanted to break out of the trap.

- I used the debt snowball method to pay off my cards. I started with the lowest balance card first and paid the minimum on the other card. Once I paid of the smaller card I put that extra money on the other card along with that payment. Within 10 months I was totally out of credit card debt and promised myself I would never let that happen again. I also started closing the credit cards so I would not be able to use them again. I took that extra money and was able to pay my car off early.

- I also started saving in a separate account for things that I wanted and worked on being patient.

Paying off credit card debt is not easy but if you really start to think before swiping that card, it really can make a difference and keep you off that spinning wheel of debt. If you think about how many hours you have to work to pay for what you want, it will help to bring that awareness to the forefront. Pick up extra shifts or income if you can. Most importantly, practice on intentionality and let go of instant gratification. Your reward will be so much greater.